The COVID-19 pandemic has seen businesses changing from the normal physical purchases and meet ups to online engagements.

In support of E-Commerce in Kenya, Payindex Limited has today launched TradeSure Escrow services, an online platform that offers safe and secure service to support online transactions in Kenya and the rest of the world. The Tradesure platform is a secure transaction platform that guarantees both immediate payment and confirmed delivery of goods or services.

Currently TradeSure acts as an Mpesa merchant with a dedicated paybill to hold the escrow payments. Payments are automatically made directly from the paybill to the seller once the transactions are completed or reversals effected back to the buyer, should the transaction be cancelled.

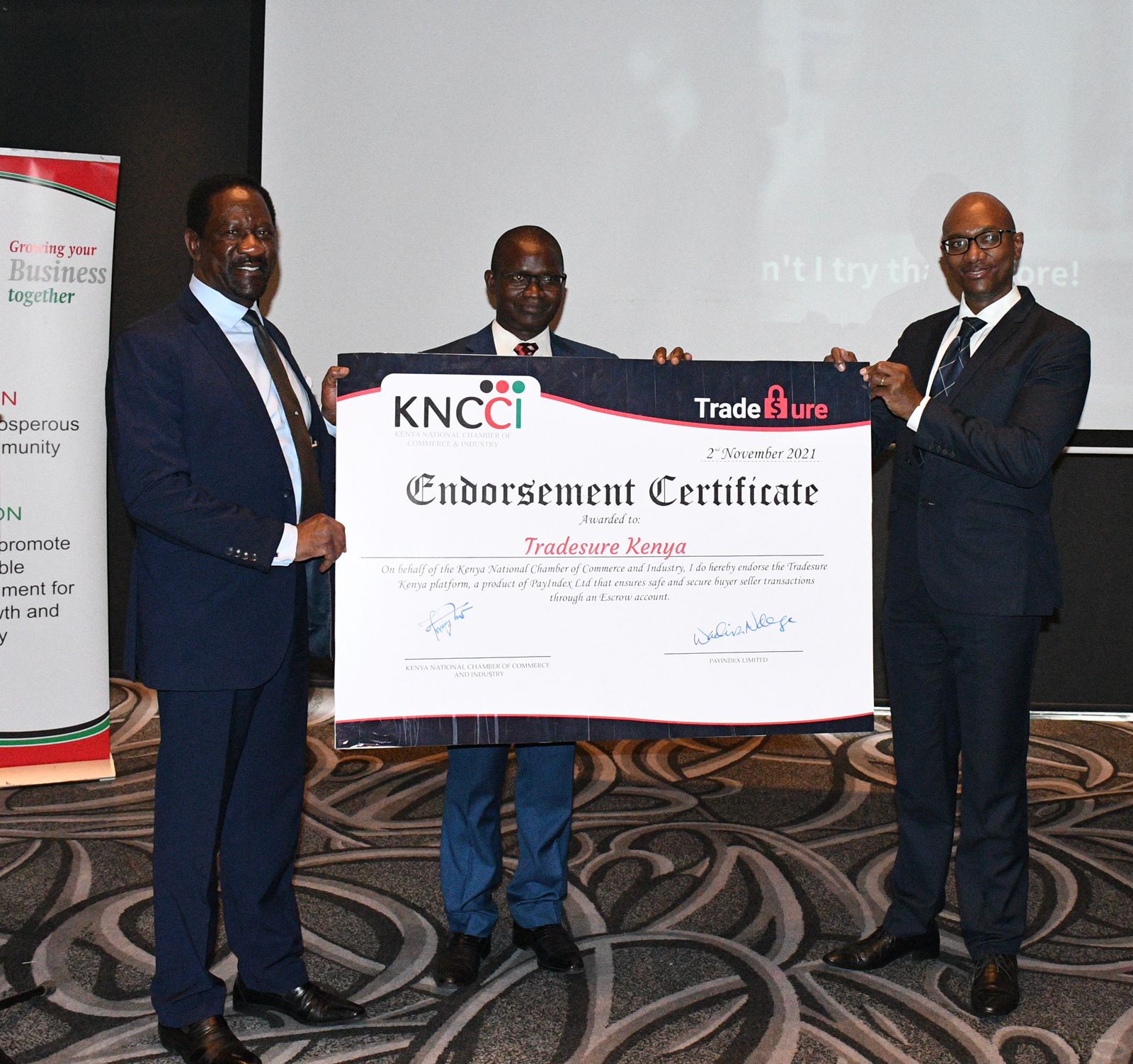

Speaking on behalf of the Chamber President Mr. Richard Ngatia at the platform launch that took place today at Trademark hotel in Nairobi, Chairman of the KNCCI banking and finance committee and Group Managing Director Metropol Coporation Mr. Samuel Omukokho expressed that the TradeSure Escrow services is a timely business innovation. Mr. Omukokho appreciated the role of the platform in supporting business transactions especially for SMEs which are hardly hit by the prevailing COVID-19 that has led to an increase in adoption and utilization of online platforms and e-commerce to reach customers.

On his part, KNCCI CEO Mr. Samuel Matonda acknowledged that TradeSure is a stepping stone to enhancing bilateral trade therefore appreciating both the physical and virtual audience for being part of the launch that would be beneficial to the Kenyan business community. He urged the audience to subscribe to KNCCI membership and gain from the numerous services and benefits offered by KNCCI.

Additionally, the Chamber CEO encouraged Chamber Members to take advantage events organized by the chamber like the ongoing Expo2020 Dubai and the upcoming trade mission to DRC Congo scheduled from 29th November to 13th December, 2021.

As highlighted by the CEO Payindex Limited Mr. Wachira Ndege, most online transactions are either pay in advance and await delivery or order and pay upon delivery. However, this arrangement presents risks for online transactions. For the Seller the possibility the Buyer will not pay on delivery. For the Buyer there are possibilities that the Seller delays or does not deliver at all, or wrong item is delivered.

According to Mr. Ndege, Tradesure platform is meant to handle all these uncertainties in business engagements both locally and internationally and thus a boost to risk reduction in trade transactions.

The Tradesure platform prevents the risk of fraud or default, offers a solution to the perennial cash flow and liquidity challenges that SMEs face due to late or non-payment of debts.

Leave A Comment