Recolte Limited , a corporate member of KNCCI has partnered with Standard Investment Bank to launch RecoSIB, a Trade Finance Intermediary an entity created to provide innovative collateral free short-term financing to small businesses to enable them manage their working capital needs particularly access to trade finance solutions for businesses.

The credit solutions include;

- Local Purchase Order (LPO) financing

- Contract Financing

- Reverse Factoring

- Invoice Discounting

RecoSIB seeks to cater for suppliers and contractors whose business growth has been hampered by stringent measures instituted by conventional short-term financiers.

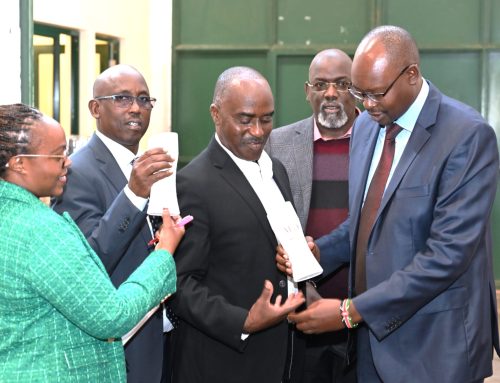

In a statement, David Muia, RecoSIB CEO said, “I am excited that we are finally able to create trade finance solutions that are more inclusive. For far too long, suppliers and contractors have been limited by the stringent measures instituted by conventional short-term financiers.” He added, “Now, SME’s who are usually experts, have the confidence to chase for business without worrying about the working capital requirement they need to Keep Growing.”

Speaking at the launch, Nahashon Mungai, Executive Director for Global Markets at SIB said, “We have always prided ourselves on creating innovative and differentiated financial solutions for individuals and businesses. We are happy that through RecoSIB, we shall be able to actively participate in offering viable financing solutions to businesses.”

Leave A Comment