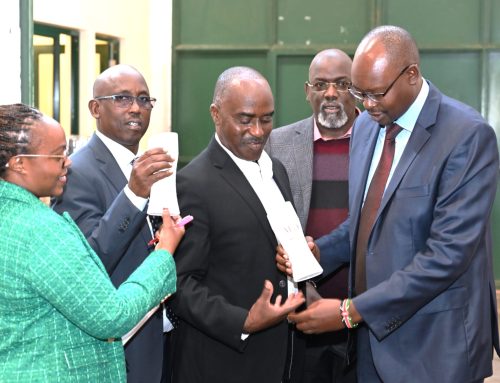

This morning the Kenya National Chamber of Commerce & Industry (KNCCI) in collaboration with Diamond Trust Bank held a financial literacy training at DTB Centre. The training was attended by KNCCI members and the general public drawn from various sectors such as exports, food, insurance, Information technology, consultancy, academia, finance and events.

The Chamber 1st Vice President Dr. Erick K. Rutto kick started the training by appreciating DTB bank for being platinum members of KNCCI and organizing the forum that is beneficial to all members and the general public. He gave an overview of KNCCI’s history and mandate. KNCCI membership constitutes of Micro, Small enterprises (MSEs) Medium, and Large Enterprises. Members and the business community at large are the heartbeats of the institution.

In his remarks he stated that there are over 2 million adults across the globe who lack access to financial services.17% of Kenyan adults do not have access to financial literacy and therefore, being the backbone of collaborations between the two organizations.

Director, Sales at Diamond Trust Bank, Dr. Kennedy Nyakomitta made a presentation on services that empower business owners to grow their businesses through capacity building programs so they are better equipped to run their operations.

DTB’s Channels, Products & Services Suite

- DTB Current Accounts: Deposits:

Current Accounts KES & in major international currencies

- Business Focused lending:

Financing of corporates, SME lending solutions- working capital, CGS Scheme asset financing (including hire purchase and insurance premium financing), term loans and project financing solutions, and mortgage financing etc.

- Trade Financing:

Facilitation of trade financing through products such as letters of credit, guarantees, bills for collection, bills discounting, bonds etc

- Treasury:

Foreign Exchange (spot and forward deals including SWAPS)

Money Market (Domestic and foreign currency)

Facilitation of investments in Government Securities

- DTB Cash Deposit Machine Solutions:

The solution allows DTB customers to easily and conveniently deposit cash into their DTB account real-time.

- DTB Cheque Truncation Solutions:

The solution allows DTB customers to easily and conveniently deposit cheques into their DTB account real-time.

- Value Chain Financing (Both distributor and buyer):

A supply chain finance model incorporating an invoice discounting facility for suppliers as well as a buyer invoice financing facility for sellers that bank with DTB.

William Kinai Financial literacy consultant, Novatus Limited conducted a training on bookkeeping an taxation to enable participants to develop compliance and financial accounting processes that will enhance their access to debt capital.

KNCCI appreciates DTB for conducting the training and look forward to having more engagements that will benefit the members.

Leave A Comment